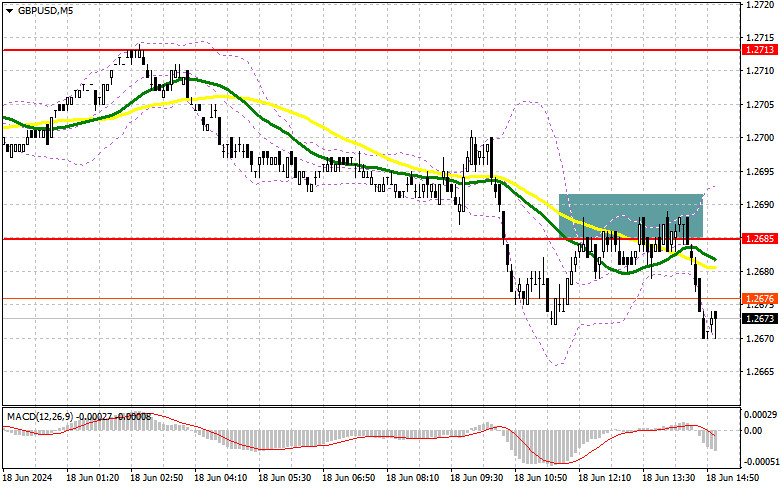

In my morning forecast, I highlighted the 1.2685 level and planned to make market entry decisions from there. Let's look at the 5-minute chart and analyze what happened. The breakout and reverse test of this range led to a sell entry point for the pound, resulting in a drop of almost 20 points at the time of writing. The technical picture for the second half of the day was slightly revised.

To Open Long Positions in GBP/USD:

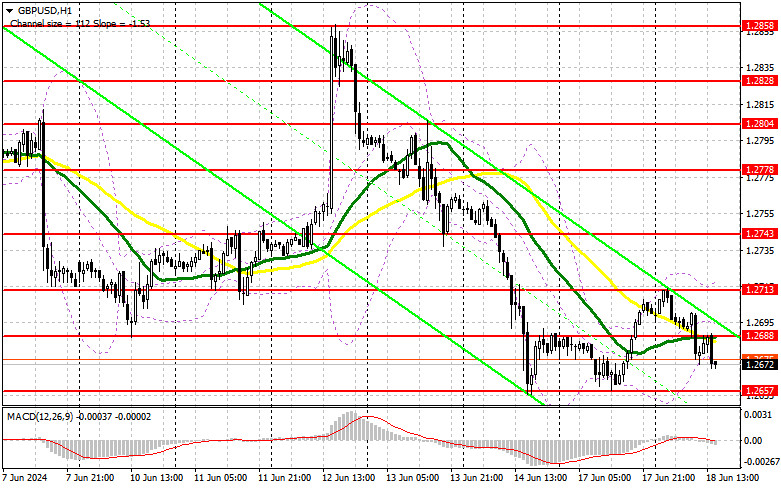

Given the complete absence of UK statistics, the pound's fall was not surprising, as I warned in the morning forecast. However, the situation could change in the second half of the day after the release of US data on retail sales volume, industrial production volume, and manufacturing production volume. If the figures are worse than economists' forecasts, it will put pressure back on the dollar, leading to a rise in the pound. Otherwise, the decline in GBP/USD will continue, which can be taken advantage of around 1.2657. Only another false breakout formation, similar to yesterday, will provide an entry point for long positions aiming to return to the 1.2688 level – the new resistance. A breakout and reverse test from top to bottom of this range will be a suitable condition for buying, aiming to update 1.2713. The furthest target will be the area of 1.2743, where I plan to fix the profit. In the scenario of a decline in GBP/USD and the absence of bullish activity around 1.2657 in the second half of the day, the pound risks entering a bearish market phase, increasing pressure on the pair. This will also lead to a decline and update of the next support at 1.2631. Only a false breakout formation will be suitable for opening long positions. I plan to buy GBP/USD immediately on a rebound from the minimum at 1.2606, aiming for an upward correction of 30-35 points within the day.

To Open Short Positions on GBP/USD:

Sellers control the market, and to continue the bearish trend, they only need to defend 1.2688, which the pound might reach in the second half of the day after weak US statistics. A false breakout formation will be a suitable option for opening short positions, aiming for a decline to the support at 1.2657. A breakout and reverse test from the bottom to the top of this range will deal another blow to buyers' positions, removing stop orders and opening the way to 1.2631 – the new weekly low. The furthest target will be the area of 1.2606, where I plan to fix the profit. Testing this level will also indicate a strong bearish market. In the scenario of GBP/USD rising and the absence of bearish activity at 1.2688 in the second half of the day, buyers will try to restore the market balance. In this case, I will delay selling until a false breakout at 1.2713. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2743, targeting a downward correction of 30-35 points within the day.

The COT report (Commitment of Traders) for June 11 showed an increase in long positions and a decrease in short ones. The Bank of England meeting is coming up, which may continue to prepare markets for rate cuts in late summer – early autumn this year. This could put pressure on the British pound, as the regulator's dovish stance will strongly contrast with the actions of the Federal Reserve, which left interest rates unchanged last week, signaling only one possible rate cut this year. All this will play in favor of the dollar. The latest COT report shows that long non-commercial positions increased by 8,182 to 110,300, while short non-commercial positions decreased by 729 to 58,179. As a result, the spread between long and short positions fell by 4,775.

Indicator Signals:

Moving Averages:

Trading is conducted below the 30- and 50-day moving averages, indicating a further decline in the pair.

Note: The author considers the period and prices of the moving averages on the hourly H1 chart and differs from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2670, will act as support.

Description of Indicators:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.